India’s Smartphone Export Boom: How Mobile Devices Surpassed Oil and Diamonds in FY2025

In an unprecedented shift in India’s export landscape, smartphones have officially become the country’s top exported commodity for fiscal year 2025. According to government data, India exported smartphones worth $24.14 billion , marking a stunning 55% year-on-year growth.

This leap has pushed smartphones past traditional export giants like refined petroleum products and cut and polished diamonds — two sectors that have historically driven India’s foreign trade. The surge underscores India’s evolving identity from a consumption-driven mobile market to a globally competitive manufacturing base.

What drove this shift? Which companies are leading the charge? And what does it mean for India’s role in the global technology supply chain? Here's a comprehensive look at one of the country’s most important economic pivots.

Smartphones Become India's Leading Export Product

For decades, India's primary exports revolved around oil-based products, precious gems, and textiles. Smartphones had never even broken into the top five. That changed in FY2025.

As per figures from the Ministry of Commerce and the India Cellular and Electronics Association (ICEA), the country exported smartphones worth ₹2 lakh crore, equivalent to $24.14 billion, outpacing:

- Petroleum products: $23.5 billion

- Polished diamonds: $22.9 billion

- Pharmaceuticals: $17.2 billion

This marks the first time an electronics category has topped India’s export chart.

What Triggered This Boom in Smartphone Exports?

Several strategic and geopolitical factors combined to propel India’s smartphone exports into the top slot. The three biggest drivers were:

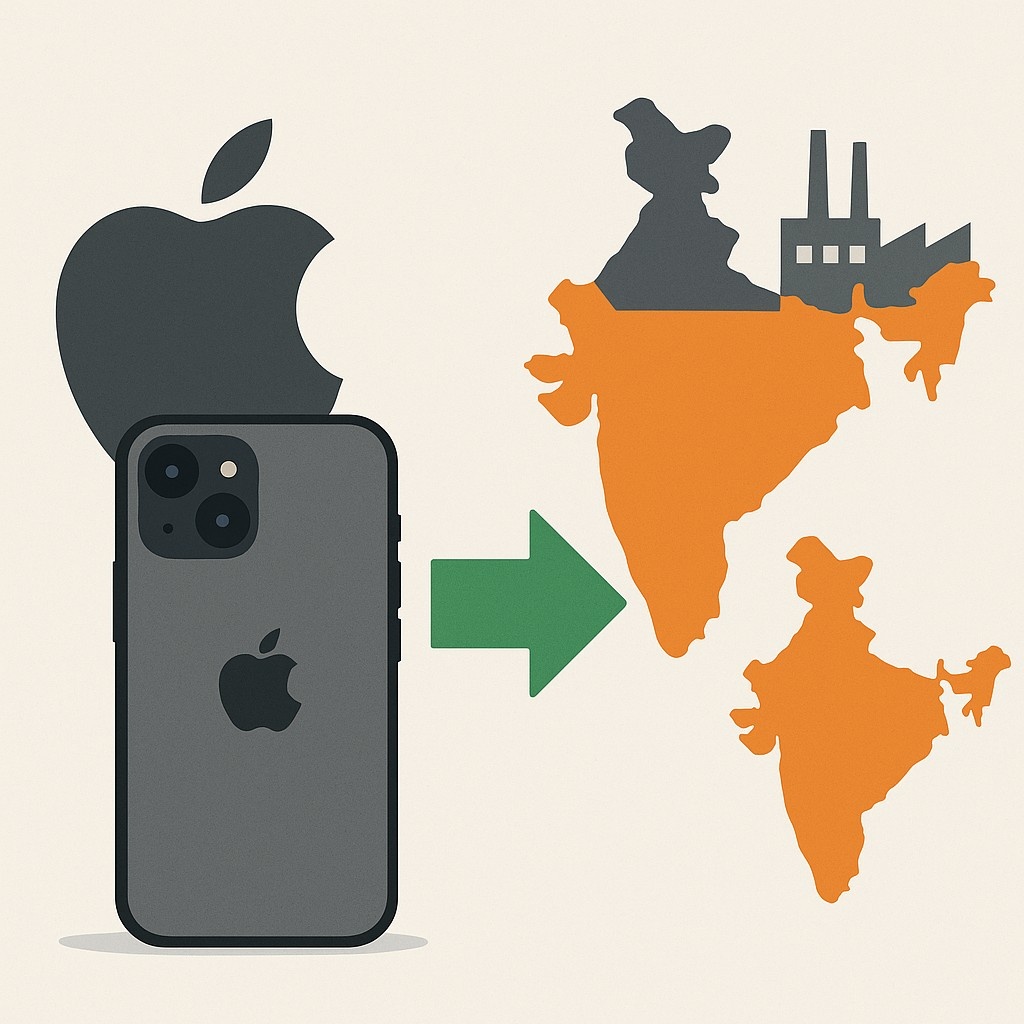

- Apple’s Manufacturing Expansion in India

Apple played a dominant role in India’s export surge. Over the past two years, the company has increasingly shifted iPhone production from China to India through its contract manufacturers: Foxconn, Pegatron, and Wistron (now Tata Electronics).

By FY2025, Apple exported nearly $12 billion worth of iPhones from India, contributing almost 50% of the total smartphone export value.

This shift was not just about lower labor costs. It was driven by supply chain diversification in response to US-China tensions and by India’s production-linked incentive (PLI) scheme, which financially rewards high-output exporters. - Success of the PLI Scheme

India’s PLI scheme, introduced in 2020 to promote domestic manufacturing, provided key incentives for companies producing smartphones for export. It led to massive expansion by global and local firms alike, including Samsung, Lava, Dixon, Vivo, and Oppo.

The result: most of these brands not only manufacture for Indian consumers but also ship to overseas markets — particularly North America, Europe, and the Middle East.

By the end of FY2025, nearly 98% of all phones manufactured under PLI were exported. - Rise of the US and Europe as Importers

The United States has now emerged as the single largest importer of smartphones made in India, accounting for over 26% of total export volume, up from 16% the previous year.

The European Union follows closely behind, and new demand is emerging from Latin America, the UAE, and South Africa.

With China increasingly sidelined as a supply hub for Western nations, India’s export opportunity continues to grow.

India’s Transition from Importer to Exporter

Less than a decade ago, India was almost entirely dependent on imports for smartphones, mainly from China and South Korea. Today, it has reversed that position.

India is now:

- The second-largest smartphone manufacturer in the world after China

- A contributor to over 16% of global smartphone shipments

- On track to exceed $30 billion in smartphone exports by FY2026

The scale and speed of this transformation are drawing comparisons to China’s own manufacturing ascent in the early 2000s.

“We have moved beyond assembly. India is building a full-scale smartphone export ecosystem, from printed circuit board assembly to packaging and outbound logistics.”

Pankaj Mohindroo, Chairman of ICEASupporting Infrastructure Played a Silent Yet Vital Role

Alongside policy incentives, India’s logistics and infrastructure push quietly enabled this export boom.

Key developments included:

- Upgraded air cargo capacity in Delhi, Hyderabad, and Chennai, optimized for electronics exports

- Dedicated freight corridors and inland container depots for faster movement of finished goods

- Streamlined customs processes for faster clearances (now averaging under 12 hours for most smartphone shipments)

While these changes drew less public attention than policy schemes, they proved essential for just-in-time delivery and bulk international orders.

What Are the Challenges Ahead?

Despite the export success, several key challenges remain:

- High Dependence on Imported Components

While India assembles and tests smartphones at scale, most key components are still imported — especially from China. These include:- Chipsets (SoCs)

- Display panels

- Camera modules

- Batteries and semiconductors

- Limited Value-Added R&D

India’s smartphone export ecosystem is still primarily hardware-focused. Software, AI development, chipset design, and mobile operating systems continue to be dominated by foreign companies. Long-term growth will depend on developing in-house design and innovation capabilities. - Global Supply Chain Volatility

The electronics sector is highly sensitive to disruptions — whether from geopolitical tensions, raw material shortages, or shipping bottlenecks. India’s rising manufacturing status will need corresponding risk mitigation strategies to maintain momentum.

Global Response to India's Rise

International reactions to India’s smartphone manufacturing boom have been broadly positive.

The United States, European Union, Japan, and other countries view India as a reliable alternative to China in the tech hardware space.

Tim Cook, during his 2024 India visit, said, “India is not just a market — it is a strategic production hub for Apple’s future.”

Tim Cook, CEO of AppleStatements like these have led to new investments, not only from Apple but also from component suppliers setting up ancillary units near Indian manufacturing hubs.

What This Means for India’s Broader Electronics Sector

India’s success in smartphone exports sets the stage for broader ambitions. The government has already expanded PLI programs to cover:

- Laptops and tablets

- Wearables and hearables

- Networking equipment and telecom gear

- Semiconductor assembly and packaging

The ultimate goal: grow India’s total electronics production to $300 billion by FY2026, with $120 billion in exports.

The Road Ahead: Can the Momentum Continue?

If India can address its dependency on imported components and strengthen local R&D, it has the potential to become a comprehensive global electronics manufacturing hub.

For that, additional reforms will be needed:

- Scaling up local semiconductor manufacturing

- Investing in skill development for high-end hardware and software roles

- Enhancing ease of doing business in tier-2 and tier-3 cities for industrial growth

As India builds on the FY2025 success, attention will be on how sustainable this growth can be — and whether it can extend into adjacent sectors like electric vehicles, IoT, and semiconductor design.

Conclusion

India’s smartphone export milestone in FY2025 is more than just a trade statistic — it represents a paradigm shift. From being one of the world’s largest importers of mobile devices, India has become a key exporter, supplying premium smartphones to global markets including the United States and Europe.

With $24.14 billion worth of smartphones shipped last year, India has not only surpassed its traditional export strongholds but has firmly established itself on the global tech manufacturing map.

If India can now build deeper capabilities — in R&D, component production, and chip design — the country may not just participate in the next tech revolution. It may help lead it.