Intel Touts Foundry Breakthroughs — But the Real Test Is Still Ahead

On April 29, 2025, at its “Foundry Direct Connect” event in San Jose, Intel pulled out all the stops to show the world that it’s serious about becoming a major global foundry player — again.

The event wasn’t small. Over 1,000 customers, partners, and ecosystem stakeholders gathered as Intel highlighted its progress in advanced chip manufacturing, laid out plans for next-gen process nodes, and tried to prove it can compete toe-to-toe with foundry giants like TSMC and Samsung.

And while there’s no doubt Intel is making technical headway, the bigger question remains: can they execute at scale — and deliver when it really matters?

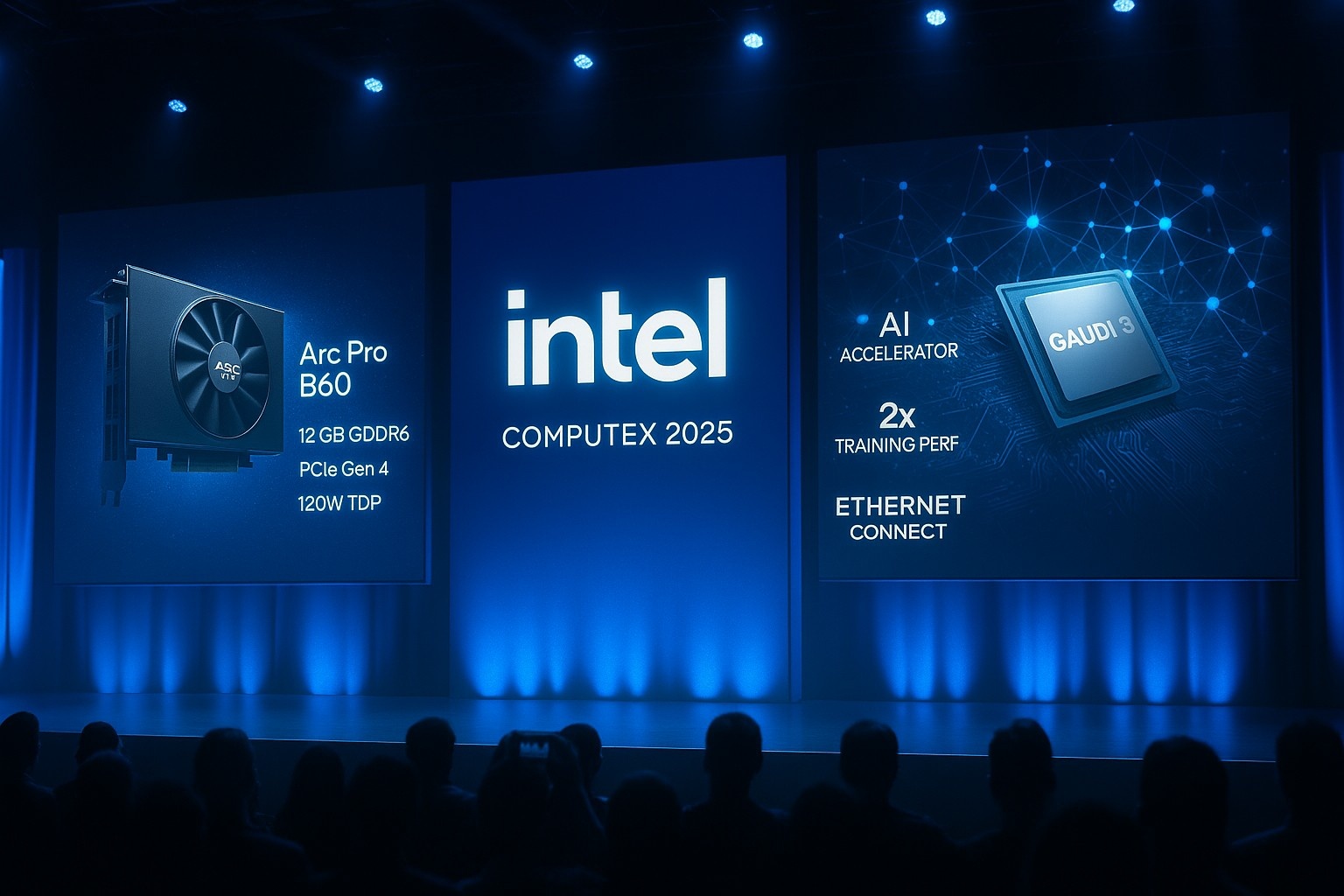

Intel’s Big Pitch: 18A Ramping, 14A on Deck

At the center of Intel’s announcements was progress on its much-hyped “Intel 18A” process — a key step in the company’s roadmap to catch up in leading-edge manufacturing.

According to Intel:

- 18A is ready for high-volume production starting later in 2025

- It’s already been used by “multiple customers,” including Broadcom and Nvidia, to build test chips

- The 18A node uses RibbonFET transistors and PowerVia backside power delivery — both of which are core to Intel’s strategy to leapfrog competitors

But that wasn’t all. Intel also announced that several new customers are now planning to build on the upcoming 14A process — which will feature high-NA EUV lithography, an industry-first tech that promises higher precision and smaller nodes.

It’s a big technical leap. But Intel knows it needs more than just a better process — it needs trust from customers who’ve spent the last decade watching the company miss deadline after deadline.

A New CEO, A Sharper Focus

This event also marked one of the first public showcases under Intel Foundry’s new CEO, Lip-Bu Tan — a legendary figure in the semiconductor world, known for his leadership at Cadence Design Systems and deep ties across the chip industry.

Tan’s message? Customer-first culture. Transparency. And delivery.

He acknowledged that Intel’s foundry efforts in the past lacked the agility and openness needed to serve fabless customers. Now, the goal is to make Intel a true partner, not just a manufacturing vendor.

It’s a cultural shift Intel desperately needs — especially as it tries to convince big chipmakers to entrust them with core production work.

The Real Target: Nvidia, Qualcomm, Amazon, and… Apple?

Let’s be clear: this isn’t about making random test chips or low-volume custom orders. Intel wants to attract the same billion-dollar customers that drive demand at TSMC:

- Nvidia, which dominates AI chip supply chains

- Qualcomm, constantly chasing better mobile performance

- Amazon and Microsoft, both investing heavily in custom silicon for AI and data centers

- And yes, even Apple, though that would be a long shot

To win those clients, Intel needs to prove it can:

- Hit process milestones on time

- Offer competitive pricing

- Deliver advanced packaging and reliability at scale

So far, the 18A test chips from Nvidia and Broadcom are a promising signal, but it’s still very early. Until real, high-volume chips ship from Intel’s Arizona and Oregon fabs — and meet yield expectations — it’s all potential, not proof.

What Sets Intel Apart — If It Works

Intel is pushing a foundry model that’s not just “build-to-print.” It’s about vertical integration and co-optimization:

- Chips built with Intel process tech

- Paired with Intel's own packaging solutions (like EMIB and Foveros)

- And supported by EDA partners like Synopsys and Cadence

If done right, this gives Intel a chance to offer a full-stack manufacturing platform, ideal for startups or even big players wanting tight integration without building their own fab.

That’s the vision. But again, execution will be everything.

Advanced Packaging Is a Big Part of the Story

While much of the focus was on process nodes, Intel also spent time showing off its advanced packaging capabilities — a key differentiator as chip design moves from monolithic dies to multi-die chiplets.

With technologies like:

- Foveros Direct (die-to-die stacking)

- EMIB (interconnect bridges for chiplets)

- Glass substrates for future high-density designs

Intel is making a play for the next generation of AI and HPC chips — where performance-per-watt and bandwidth matter more than sheer clock speed.

Expect these to play a major role in wooing AI hardware companies and next-gen compute startups.

What Intel Still Has to Prove

Despite all the tech optimism, Intel still faces huge questions:

- Can it deliver on time at scale?

- Will its fabs hit competitive yields?

- Will global customers trust Intel not just as a chipmaker — but as a fab-for-hire?

- And perhaps most importantly — will Intel’s pricing be competitive with TSMC’s?

There’s also geopolitical context here. With the U.S. government pushing CHIPS Act funding, and tensions rising over Taiwan, many Western companies are looking for non-Asian foundry partners.

Intel could be that partner — but only if it proves it’s reliable.

Investor and Industry Reactions

Investors have been cautiously optimistic. Intel’s stock ticked up slightly after the event, and analysts noted that if 18A ships in volume on time, it could finally put Intel on competitive footing.

But Wall Street is tired of hearing about roadmaps. They want proof — and revenue.

For customers, the reaction is more positive. Several fabless companies told Reuters and Bloomberg that they’re actively evaluating Intel Foundry Services now that 18A looks real. But again — test chips are one thing. Full production orders are another.

Final Thoughts

Intel’s April 29 showcase was impressive — not just because of the tech, but because it finally felt focused. Under new leadership, with clearer messaging, and actual customer traction, Intel Foundry might finally have a shot at playing in the big leagues.

But this isn’t a comeback story yet.

It’s a cliffhanger.

Intel has the roadmap. It has the fabs. It’s got some marquee test chips underway.

Now it needs to deliver at scale, earn trust back, and prove it can go toe-to-toe with TSMC in the most cutthroat industry on Earth.