U.S. Signals Shift in AI Chip Export Rules – Industry, Allies, and Global Tech Balance in Focus

On April 29, 2025, the United States made a headline-making move that could reshape the global AI race. The federal government officially signaled that it may revise its AI chip export rules, a decision that comes after months of tension — not only with rival nations like China, but also with U.S. allies and leading tech companies.

What started as an attempt to secure America’s technological edge is now becoming a complex web of diplomacy, economics, and competitive pressure. And at the center of it all are a few millimeters of silicon — AI chips — that power everything from large language models to autonomous drones.

How Did We Get Here?

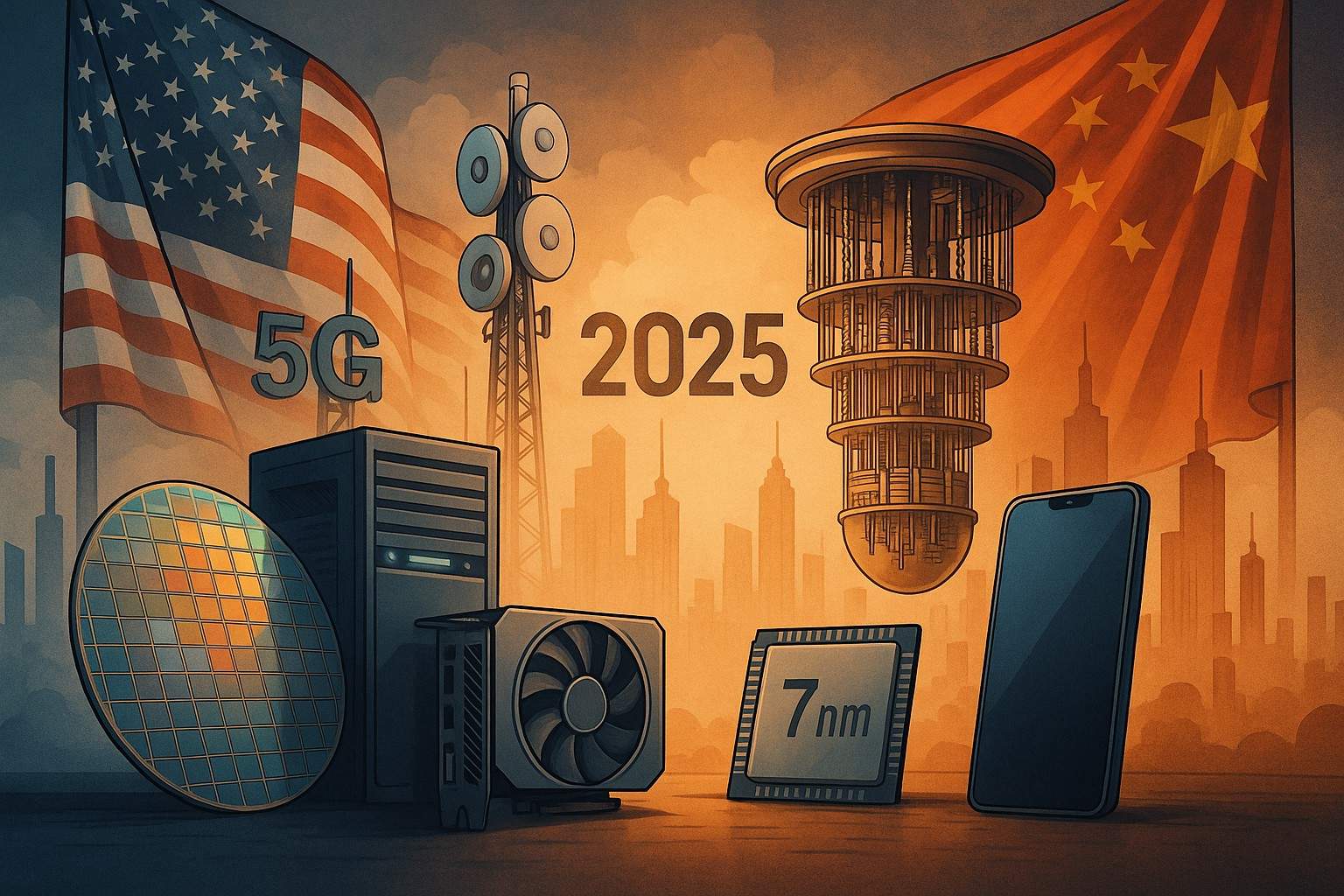

In late 2024, the U.S. administration under President Biden had rolled out a strict export control framework aimed at limiting the global sale of high-end AI chips, especially those used in military and surveillance applications. The motivation was national security: keep cutting-edge chips out of the hands of adversaries, especially China, Russia, and Iran.

To enforce this, the U.S. created a three-tier classification system for countries:

- Tier 1: Nations like the UK, Canada, and Germany — open access to American chips.

- Tier 2: Countries like India, Brazil, and Israel — allowed but under quantity caps and review.

- Tier 3: Restricted nations like China — full bans on AI chip imports.

At first glance, it looked like a solid strategy. But soon, it started to fall apart.

Industry Rebellion: Big Tech Starts Losing Patience

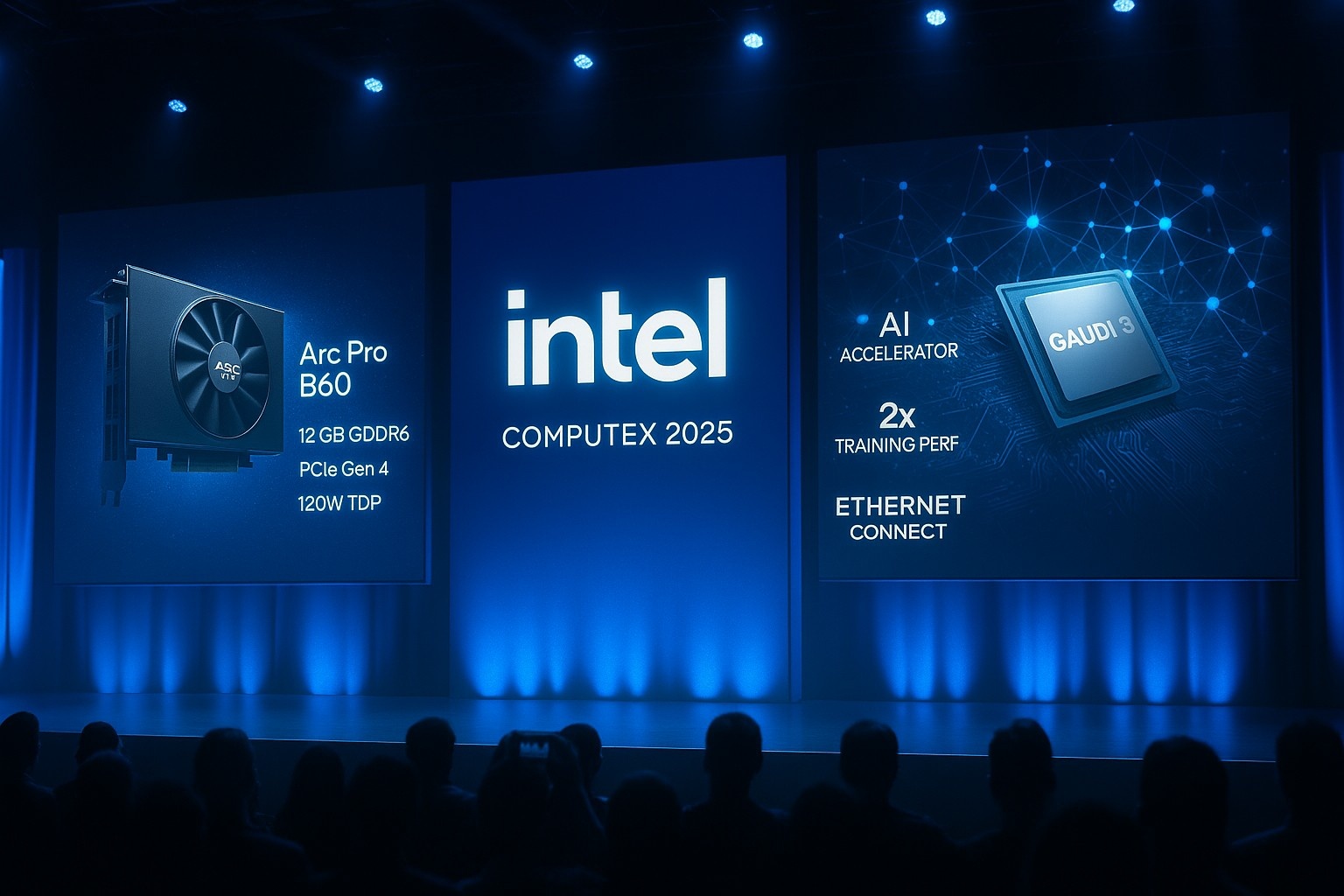

It wasn’t long before the American semiconductor giants started ringing alarm bells. Nvidia, AMD, and others were suddenly dealing with major order cancellations, blocked shipments, and confused international clients. Some of their most profitable products, such as Nvidia’s H100 and H20 AI chips, were stuck in legal limbo.

- Nvidia projected a $5.5 billion revenue hit due to the rule.

- AMD, less vocal but still affected, reported a $1.5 billion shortfall.

The tech CEOs didn’t mince words. They warned that if the U.S. didn’t act soon, foreign competitors would swoop in, and American leadership in AI hardware could be permanently eroded.

The companies also argued that the restrictions were too blunt and bureaucratic, treating longtime allies like suspicious actors. India, for example, was placed in Tier 2 despite its growing closeness to Washington — a move that sparked diplomatic confusion and irritation in New Delhi.

Allies Confused, China Benefitting?

In public, the U.S. held firm. But behind closed doors, officials were getting flooded with concerns from global partners. Many asked: Why is our access to advanced chips being limited if we’re strategic allies?

Meanwhile, reports began to surface that Chinese companies were still acquiring powerful chips, just through third-party vendors and workaround import channels via Hong Kong and Southeast Asia.

This unintended loophole meant the very nations the U.S. was trying to block were adapting, while allies and American firms were left struggling.

Trump Administration’s Response: Rethink Everything

Enter the Trump administration, which took office in January 2025. While still aggressive on national security, the Trump team quickly realized that the tier system wasn’t working.

So on April 29, they quietly announced plans to revoke the three-tier export framework and replace it with a bilateral agreement model.

What does that mean?

- Instead of a rigid tier list, the U.S. will now negotiate chip access rules individually with each country.

- These bilateral deals will consider:

- The country’s trust level

- Their AI use cases (military vs. civilian)

- Their own export controls and safeguards

- Each agreement would be flexible, reviewed regularly, and tailored to that nation’s role in the global tech ecosystem.

While details are still being finalized, this new system is expected to streamline access for friendly nations while maintaining firm restrictions on adversaries.

What It Means for the Global AI Market

This policy shift is about more than paperwork. It could reshape the entire global AI supply chain.

- American chipmakers like Nvidia, Intel, AMD, and Qualcomm could regain access to large markets like India and Southeast Asia — unlocking billions in potential sales.

- Allied countries may now feel more included and less controlled, improving trust in American leadership in tech governance.

- China’s strategy may change, as the U.S. closes loopholes and shifts focus to traceable, agreement-based distribution.

But there are still big questions:

- Will these bilateral deals be transparent or kept secret?

- Will enforcement be consistent?

- Can the U.S. prevent backdoor transfers of chips?

These are issues that the administration must navigate carefully.

Chip Control as a Strategic Weapon

It’s worth remembering why this issue matters so much.

AI chips like Nvidia’s H100 aren’t just for running chatbots — they’re military-grade assets. These chips power facial recognition systems, missile targeting algorithms, autonomous weapons, and more.

That’s why chip policy isn’t just an economic matter — it’s a matter of global security and power balance.

The U.S. knows that whoever controls the most advanced chips has an edge in AI warfare, surveillance, and economic competitiveness. China knows it too. That’s why this battle over tiny pieces of silicon feels like a 21st-century arms race.

Where Things Go From Here

The revised export system is still in early drafting stages, but here's what we can expect next:

- Nvidia, AMD, and other firms are already lobbying to influence the final structure

- India, Israel, and South Korea are expected to be first in line for new bilateral deals

- China will likely face tighter secondary controls to prevent indirect chip transfers

In the meantime, the current rules still apply — which means exporters and governments are walking a tightrope.

If the new system is too slow or confusing, companies may lose deals. If it’s too loose, national security risks go up. The balance has to be precise.

Final Thoughts

The U.S. government’s decision to rethink AI chip export rules is not just a policy adjustment — it’s a critical moment in the global tech race.

This is about how the U.S. chooses to lead — not just with innovation, but with rules, alliances, and strategy.

As chipmakers breathe a sigh of relief and governments prepare for negotiations, one thing is clear:

The future of AI won't just be shaped by what’s built in labs — but by who’s allowed to buy it, and under what conditions.

And as of April 29, 2025, the game board has just been redrawn.